Research shows that people with learning disabilities are at greater risk of financial exploitation – such as phishing scams and so called ‘mate crime’, where a fraudster befriends a vulnerable person. In addition, as banking services move online or are app based, they are more likely to be digitally excluded, due to a lack of support and equipment.

“Our students and their families face a double whammy because they are less likely to earn and more likely to incur costs”

According to Abi Carter, CEO of Wandsworth charity Share Community, which supports adults with learning disabilities and autistic people, income levels can be an issue too: “Our students and their families face a double whammy because they are less likely to earn and more likely to incur costs than their fellow citizens.

“Only 26% of people with a learning disability are in work, compared to 82% of the non-disabled working age population (ONS, 2021) and disabled people already face extra costs of an average of £583 month to enjoy the same quality of life compared to non-disabled people (Scope, 2019).”

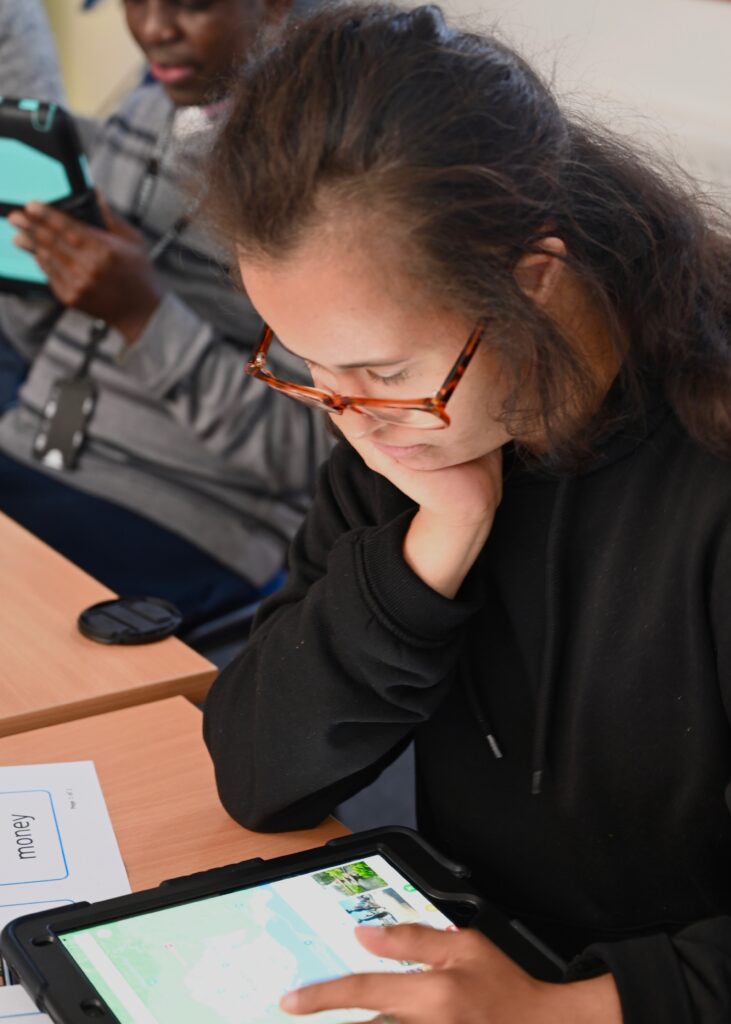

In response, a new project from Share is supporting its users to be more financially independent – leading to greater independence in general. The digital skills sessions aim to increase familiarity with the words used in banking and numeracy. Students practice viewing bank statements to understand deposits and withdrawals.

Grant Lorimer, Share’s digital finance tutor explained: “At first students found it challenging to understand the language and concepts of debits, credits and balances. But over time they have become more confident, calculating and updating their weekly statements with improved accuracy and independence, building skills and confidence in everyday financial transactions.

As with everything we do at Share, we are constantly looking at how our classes can help our students’ communication, social skills and general wellbeing.”

“As with everything we do at Share, we are constantly looking at how our classes can help our students’ communication, social skills and general wellbeing. Students explore day-to-day tasks such as shopping and saving money through role-play and discussions learning the importance of online safety and different ways to pay digitally.”

Participants also created their own videos on internet safety and security and filmed their classmates presenting their top tips for staying safe online, which they had researched. The digital programme is supported by funding from both Santander UK Foundation Limited and Wandsworth Council.

Share has just celebrated its 50th birthday. Having started out as a charity to provide work for people with physical disabilities, it today works with around 160 people a year across all disability categories, offering training and wellbeing programmes focused on personal development, practical life skills, and employability. Share works from four sites, including two in Wandsworth – Altenburg Gardens in Clapham Junction and the Share Garden in the grounds of Springfield University Hospital in Tooting, and two in Lambeth.

Find out more about the course on the Share Community website.